With the end of the financial year approaching, there are some key changes to superannuation that your company should be aware of.

Several changes to superannuation will take effect on July 1, 2022, with the goal of making it easier for people to develop retirement savings and creating possibilities for those who are younger, older, or low-income earners. Several changes are being implemented that will affect who is required to be paid superannuation, the Super Guarantee (SG) rate and who needs to meet the work test for voluntary contributions. Individuals working casually or part-time across various jobs may not currently get any superannuation contributions from employment.

The major changes that will be made as of July 1, 2022, are an increase in SG percentage and the removal of the $450 monthly SG threshold.

Increase in Super Guarantee percentage

The percentage rate for the Super Guarantee (SG) will increase from 10% to 10.5% on July 1, 2022. Employers must contribute additional money to their employees’ super accounts in accordance with the higher SG percentage rate.

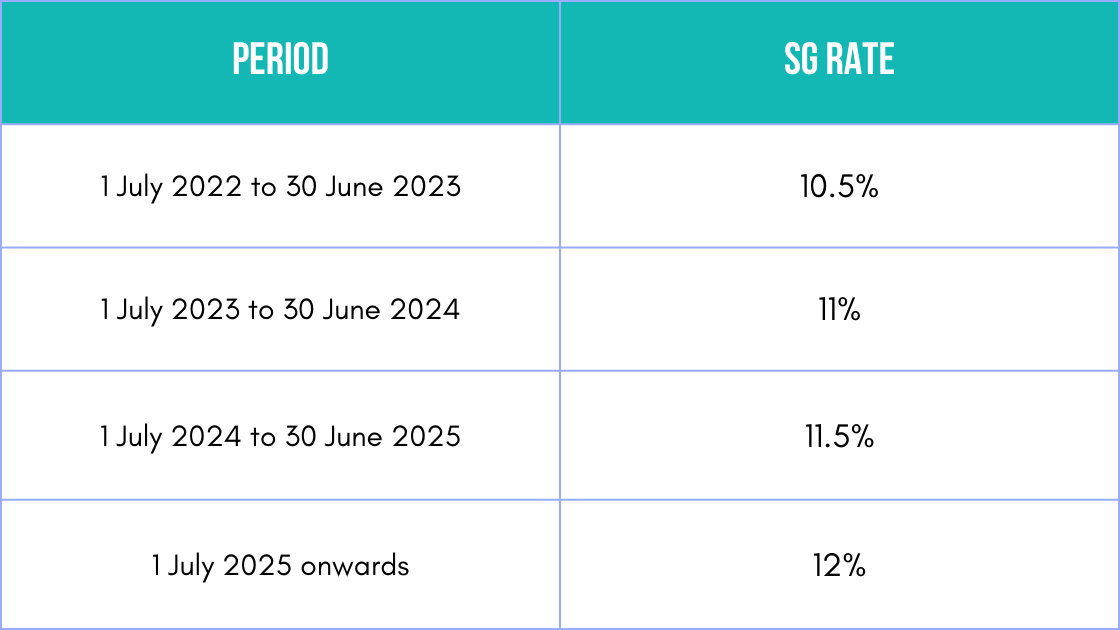

The SG has been 10% since July 1, 2021, and under the current legislative schedule, the percentage rate will rise as follows: to 11% on July 1, 2023. It will rise by 0.5% per year until it reaches its final rate of 12% on July 1, 2025.

- July 1, 2022 – 10.5%

- July 1, 2023 – 11%

- July 1, 2024 – 11.5%

- July 1, 2025 – 12%

The final rate will sit at 12%.

Removal of the $450 monthly SG threshold

Starting July 1, 2022, the $450 monthly minimum pay requirement to qualify for employer Super Guarantee contributions will be removed.

Because the monthly threshold amount has been eliminated, companies must now make super contributions for all employees (including casual and part-time workers), regardless of their earnings. Employees under the age of 18 and working fewer than 30 hours a week are the sole exceptions.

hussetHR’s recommendations

- Make sure your payroll and accounting systems are up to date with the super rate increase.

- Review your existing employment contracts. Is super currently inclusive or exclusive from your employees’ wages?

- Examine award coverage. Ensure that the rise in superannuation does not result in you paying your employees less than the award rate.

- Decide whether to pass on the super increase to your employees or absorb it.

What are the penalties for not complying with the new super rules?

An employer who fails to correctly pay the superannuation guarantee for a quarter will face a superannuation guarantee charge (SGC) (i.e., the shortfall amount, nominal interest, and an administration charge). The ATO may additionally levy a penalty of up to 200 per cent of the SGC.

How hussetHR can help

At hussetHR, we empower managers and employers to make informed decisions and support them in achieving their organisation’s goals. We apply Fair Work compliance standards, which eliminates the need for you to guess about legislation and policy.

We service a wide variety of companies and can assist you and your business with the upcoming changes to superannuation.

When determining the optimal solution for your company, it is advisable to get experienced HR advice. hussetHR is always available via phone or email and ready to advise you on the best course of action.

Call us today at 1300 487 738